Khamis: How Does Prop 19 Affect Local Homeowners?

By Johnny Khamis

While we are still battling a housing crisis in the bay area one new tool can help free up family units onto the market soon. Prop 19 passed by the voters in November 2020 allows seniors, disaster victims and the severely disabled to transfer their property tax base statewide. Now that it has fully gone into effect, many questions have been brought up about how to utilize the benefits of this new law. In this article we will take a closer look at some of the positive effects of Prop 19 and how it can help solve our need for creating more housing inventory.

You may recall that up until Prop 19 passed, Seniors (55 and older), only had the ability to preserve their tax basis on their home when moving to a home in a county accepting the transfer of basis and were required to buy a home of equal or lesser value. Under Prop 90 Seniors only had this opportunity if they were moving to Alameda, Los Angeles, Orange, Riverside, San Bernardino, San Diego, San Mateo, Santa Clara, Tuolumne, or Ventura County. This restriction had the effect of making Seniors feel trapped in homes that no longer meet their needs and created shortages for much-needed family housing.

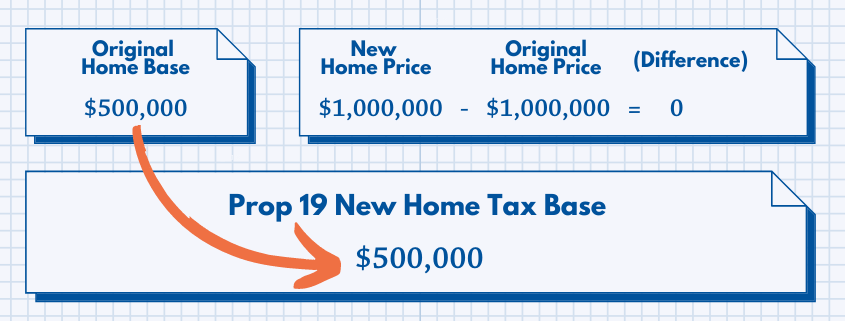

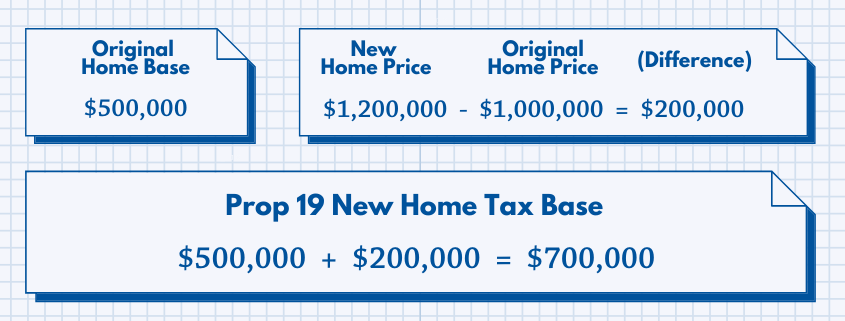

Now under Prop 19, older homeowners, those who are severely disabled, or victims of wildfires or natural disasters can move anywhere in the state without location restrictions. Qualified homeowners can transfer their existing property tax base to another property regardless of the cost of the replacement home (with an adjustment upward to their tax basis if the replacement property is of greater value).

For example, If my Aunt sold her 4 bedroom home in Morgan Hill for $1 million to move to a senior living condo in San Mateo, she is able to preserve her tax basis as long as the new condo is equal to or less than the value of the home she is selling.

Now if Aunt Lily wants a high-rise condo in San Francisco and pays $1.2 million she would still be able to preserve most of her tax basis.

The State Board of Equalization has created several new forms to enable homeowners to claim the tax savings. They have made the forms available to all county assessors, but some offices are still working on implementing them. Learn more on the Assessor’s website. You can also use SCCAOR’s Prop 19 tax basis portability calculator. The Santa Clara County Assessor’s Office has created a Prop 19 inheritance tax calculator.

Now that seniors have been given the freedom to move closer to their grown children or into housing designed to cater to their needs, we can expect the inventory of 3 and 4 bedroom housing to go up. While this is one step in increasing family housing inventory, we must continue to build more housing if we are ever going to work our way out of our housing crisis.